What You Need to Know About Navigating This Tax Season

As we begin to look ahead to the new year, let’s take a moment to reflect and celebrate. Our giving community donated nearly $1 billion for the fourth consecutive year on the Givelify mobile donation app.

In 2024, more than 1.5 million generous people gave to 70,000 churches, places of worship, and nonprofits. Givers supported causes like hunger relief, scholarships, and housing — empowering places of worship to provide spiritual guidance to their congregations while doing impactful work in their communities.

We salute the Givelify giving community for your joyful dedication to putting more good into the world. As we look forward to a new year, it’s time to focus on tax prep and navigating end-of-year documentation.

How Givelify helps your donors during tax season

Every year, Givelify provides an Annual Giving Summary to each donor. This document is sent via email on or before Jan. 31.

The Annual Giving Summary provides donors with an overview of their donation history for the previous year.

It includes their total donations, average gift amount, and an itemized list of all the gifts they made using Givelify. It also includes helpful visuals, such as a breakdown of the organizations they’ve donated to and the amount they donated each month.

The Annual Giving Summary is meant to celebrate donors for their incredible generosity and encourage them to continue giving as their hearts desire in the new year. It can also be a helpful reference for donors when they file their 2023 tax returns.

Donors can also run their donation history off the mobile giving app any time of the year.

What should organizations provide donors?

Although the Annual Giving Summary can be a helpful tool for donors to reflect on their giving for the prior year, organizations will still need to send a year-end statement to each of their donors.

This is because Givelify’s Annual Giving Summary doesn’t include gifts donors may have made to your place of worship using cash, checks, or other donation apps.

For donors to file their taxes with the IRS, they need a complete view of all the donations they’ve made, no matter which method they’ve used.

Additionally, the IRS requires that tax-exempt organizations send a formal acknowledgment letter for any donation that is more than $250. This is the letter donors will use to claim a tax deduction.

The year-end giving statement you send to your donors should incorporate all gifts made to your place of worship, whether they were given through Givelify, by cash or check, or using another donation app.

Generally, most churches, places of worship, and nonprofits provide written acknowledgment by Jan. 31 of the year after the contribution’s receipt.

The year-end giving statement should include a person’s donations made through Givelify and any other donations made last year, either through check, cash, or other means. Donors can then use this statement to complete their 2024 tax return.

The good news is that organizations using Givelify can easily create year-end giving statements for their donors using the Givelify Analytics Studio web portal.

The Analytics Studio provides data and insights for empowering deeper meaningful connections between organizations and their donors.

Use your Givelify login to access the Analytics Studio and create these statements from your organization’s dashboard.

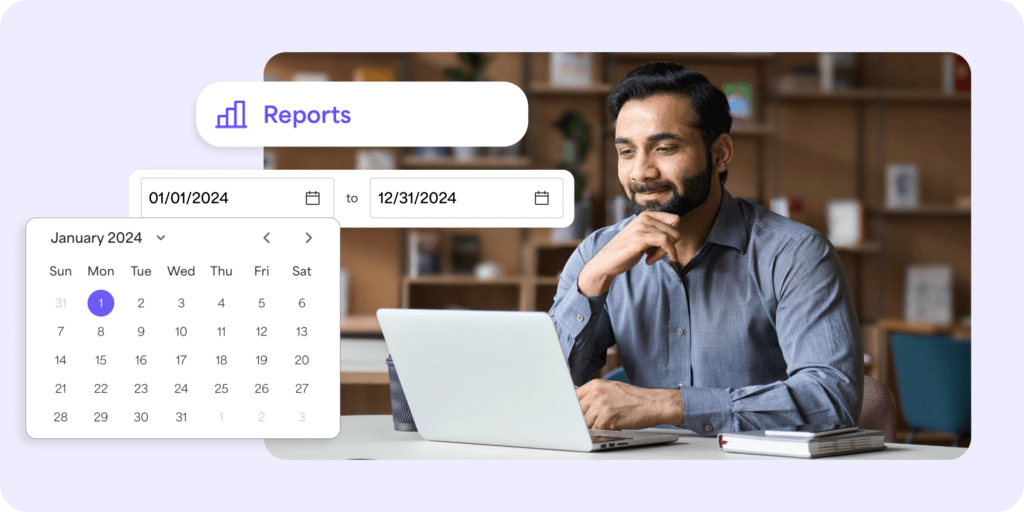

How to generate year-end giving statements with Givelify

Follow these simple steps to create year-end giving statements with Givelify:

- Login to the Givelify Analytics Studio

- Select Reports, then run the Donations report

- Select dates: Jan. 1 to Dec. 31 for Yearly Report

- Select the File format for the report and then select Generate Report

- Select the View Report History link in the message banner on the Donations Report page or select the Report History in the navigation menu to download the report

- Find the report in the list (most recent at top) and select the file name to download it to your computer

- Open the report and filter by donor name to best view the output

Once the report is populated, you can use it, along with all other donations per donor, to create your own year-end giving statement. You can do this in your Church Management System (CMS) or incorporate all cash gifts into a spreadsheet to share with each individual donor.

If you have any questions about generating year-end giving statements, reach out to Givelify Customer Support. We’d be happy to help!

Frequently asked questions you may receive from donors

See below as we answer common questions you may receive from your givers as they prepare for tax filing season.

What if a donor believes a discrepancy exists between their Annual Giving Summary and the organization’s year-end giving statement?

The Givelify Annual Giving Summary does not include donations made with cash, checks, or other donation platforms. The statement provided by your organization will have a higher gross amount than the Givelify summary because Givelify only tracks donations the donor made through Givelify. Learn more here.

What if a donor has multiple accounts?

If donors have more than one giving account, they will receive one Annual Giving Summary for each created account. They’ll see a discrepancy if they look at only one statement from Givelify and compare it to your organization’s statement.

Donors can solve this issue by merging their Givelify accounts. To consolidate these accounts and receive one summary, donors can submit a support request or contact the Givelify Customer Support team.

What if your organization’s statement credits the donor for their donation amount, less the Givelify fee?

There is no cost for donors to download and use the mobile giving app. With Givelify, there are no contracts, signup fees, monthly fees, or cancellation fees.

For organizations, a 2.9% + $0.30 transaction fee is charged per Visa, Mastercard, and Discover donation. For American Express, the transaction fee is 3.5% + $0.30.

As an organization, you may wonder, “Should we give our donors credit for the gross amount of their donation or the net amount minus the Givelify fee?” This decision is up to the organization.

Givelify recommends that places of worship and nonprofits credit their donors for the gross amount of their donations.

The organization would then keep track of the transaction fees as the cost of doing business with Givelify and list it as an operational expense line item in its budget.

A mobile and online giving platform makes tax season easier

With Givelify, there are benefits organizations won’t get with using text-to-give codes or other platforms, such as helpful tools to save time on financial oversight and reconciliation. These tools include automated and custom reports, dashboards, and more.

This video tutorial highlights the numerous tools in the Analytics Studio to help staff quickly manage finances, reconcile funds, and prepare for tax season.