The Hidden Costs of Cash App and Other P2P Payment Apps for Churches

This blog is part one of our Changes in the Giving Landscape series. This series will delve into various shifts in the giving landscape, providing insights to help your organization navigate these changes successfully.

In this first part, we’ll examine the hidden costs of peer-to-peer payment apps like Cash App for churches and places of worship, shedding light on potential challenges and offering guidance for making informed decisions about your donation tools.

•••

Peer-to-peer payment apps — Cash App, Venmo, PayPal — are everywhere these days. Chances are, you have one of these apps on your phone right now. According to Pew Research, over three-quarters of Americans have used peer-to-peer payment apps, and their popularity continues to grow.

Their appeal is undeniable: they’re quick, easy, and incredibly convenient, allowing users to send or receive money within seconds. Given their prevalence and ease of use, it’s not surprising that many places of worship have embraced these apps as a way to receive donations from their congregants.

But, while these apps offer convenience, are they the best tool for the job?

In this blog post, we’ll explore three hidden costs associated with using peer-to-peer (P2P) payment apps for donations. Through insights gathered from numerous organizations, we’ll uncover why these seemingly simple solutions can lead to significant challenges for your place of worship.

Hidden cost #1: Administrative burden

While P2P payment apps like Cash App, Venmo, and PayPal are designed for individual use, they can create a considerable administrative burden for organizations like yours. These apps are built for personal transactions and often fail to address the complex needs of churches and places of worship.

One of the most pressing issues is their lack of integration with church management systems or accounting software. Unlike dedicated donation platforms that seamlessly integrate with your financial systems, peer-to-peer payment apps require your team to manually track and transcribe each donation into your church management or accounting system.

This process is not only labor-intensive but also prone to errors. Imagine managing hundreds or even thousands of transactions by hand — it’s a daunting and time-consuming task that consumes valuable time and resources.

Additionally, P2P payment apps often provide minimal customer support. If a transaction fails, a system outage occurs, or a donor encounters an issue, you’ll likely be left to resolve the problem on your own. This lack of support can lead to lost donations, frustrated donors, and additional stress for your administrative team.

Despite their initial convenience, these hidden administrative costs can accumulate quickly. What seems like an easy solution can end up consuming considerable time and effort, proving to be a costly choice.

Hidden cost #2: Security risks

Security is another major concern when using P2P payment apps for donations. Because of their widespread use and convenience, they have become an attractive target for scammers and hackers.

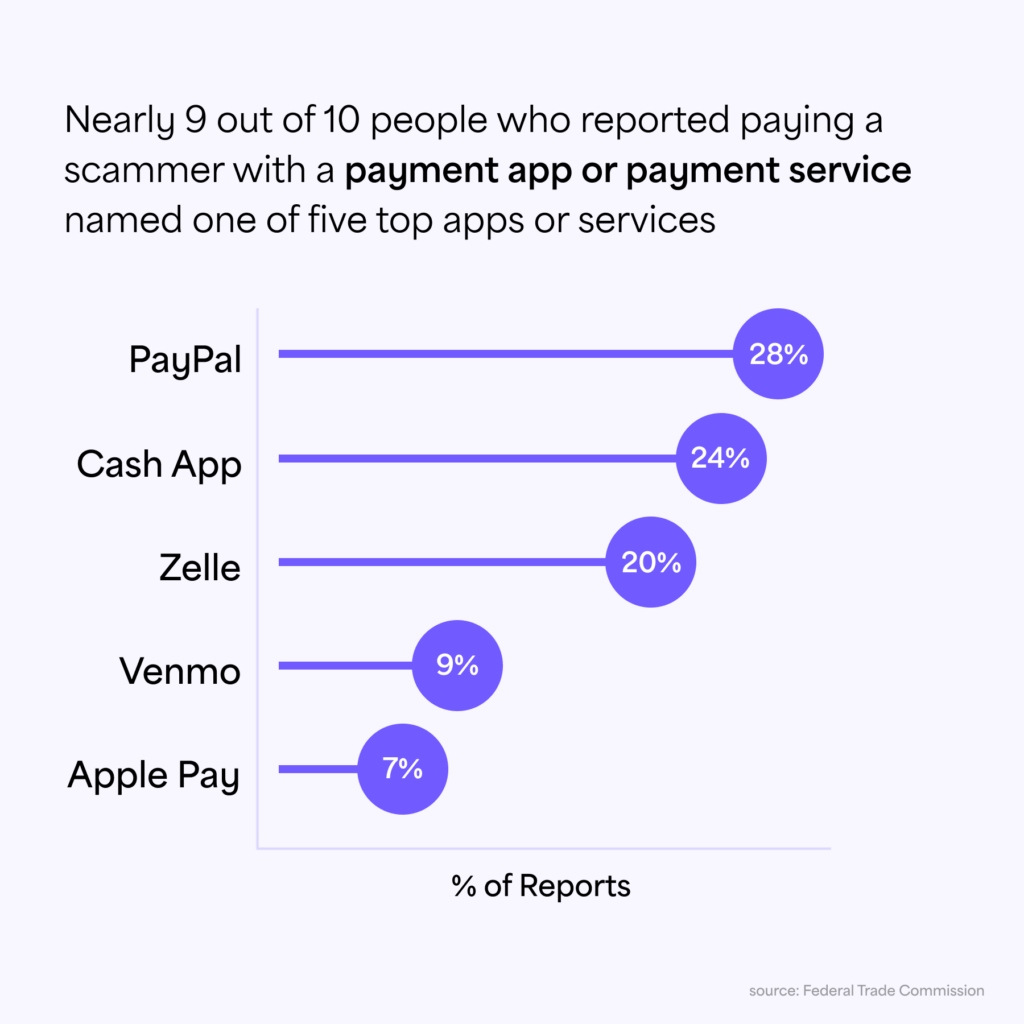

A 2022 Pew Research study found that 80% of peer-to-peer payment app users lack confidence in the platforms’ ability to protect their personal information. This skepticism is well-founded. The Federal Trade Commission reported that nearly 90% of individuals who lost money to scammers via payment apps in 2023 did so through popular peer-to-peer platforms.

Recent high-profile incidents underscore these risks. Just recently, Cash App faced a class action lawsuit due to data and security breaches, resulting in a $15 million settlement for affected users.

Similarly, the Senate is scrutinizing P2P payment app Zelle over reports of rampant fraud on its platform. According to a recent report, the National Consumers League Vice President stated, “The scale of fraud on the Zelle platform is unacceptably high.”

Scammers often use sophisticated tactics to impersonate organizations, banks, or even friends and family, making it alarmingly easy for them to trick donors into transferring funds to fraudulent accounts.

Once the money is sent, recovery is nearly impossible, putting your organization’s funds at risk and potentially damaging your reputation. This erosion of trust can have long-lasting effects on donor relationships and overall financial stability.

While P2P payment apps may offer convenience, they fall short in ensuring robust security measures for both your organization and your donors.

Hidden cost #3: Limitations & fees

Another hidden cost of using P2P payment apps for organizational giving is the various limitations and fees associated with these platforms. Many organizations are unaware that peer-to-peer payment apps offer separate account types: personal and business.

For example, Cash App has personal peer-to-peer accounts, but they also have Cash App for business. Business accounts come with different fee structures and policy requirements, charging a per transaction fee and may even impose transfer limits.

Despite these fees, P2P platforms do not provide additional features to aid in donation reconciliation or accounting. This means your organization is being charged without any of the benefit.

Peer-to-peer payment apps like Cash App are increasingly cracking down on personal accounts used for business purposes. Even though churches are tax-exempt, these platforms still classify them as businesses. This classification can lead to policy violations if personal accounts are being used for organization donations.

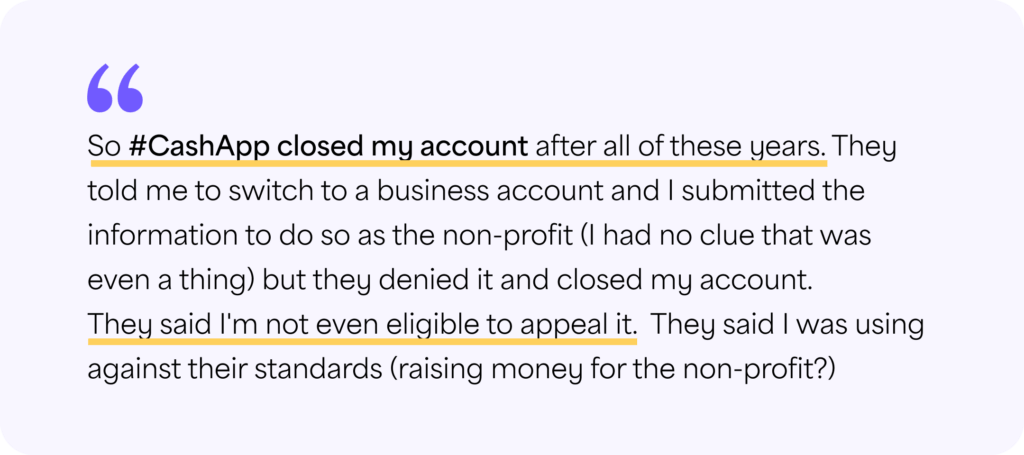

If your organization is flagged, you may receive an email or letter notifying you that you’re in violation of their policy and requiring you to switch to a business account. In some cases, failure to comply can even result in account suspension or closure.

What was once a convenience now comes at a cost, without any of the features you need to lighten the load of your organization.

A better alternative: overcoming the costs of P2P payment apps

Peer-to-peer payment apps like Cash App, Venmo, and PayPal undoubtedly offer convenience, but they were not designed with the specific needs of churches and places of worship in mind. The hidden costs — including administrative burdens, security risks, and limitations on transactions — often outweigh the initial benefits of using these platforms for donations.

To avoid these pitfalls and ensure a more secure, efficient, and manageable donation process, consider exploring dedicated giving solutions like Givelify. Designed specifically for organizations like yours, Givelify addresses the unique challenges faced by places of worship, providing a tailored approach to online giving that supports your mission while minimizing risks and administrative headaches.

By choosing a platform built with your needs in mind, you can ensure that your congregation’s contributions are handled securely and efficiently, allowing you to focus on what truly matters: fulfilling your mission and serving your community.