Aligning your Money and Mission for Greatest Impact

Mark Elsdon, in his third-of-four on his series on how to effectively raise money for churches and places of worship, explains how concentrating your money and mission into the areas needed most can be crucial for your greatest impact.

- Social Enterprise as a New Expression of Church

- Using Church Property for Mission and Revenue Generation

- Aligning your Money and Mission for Greatest Impact (current)

- Coming Soon!

Mission is primary for social impact organizations. But money is also vitally important. Aligning money with mission is one of the most important, but often overlooked, strategic activities that a social impact organization can engage in.

Consider these three scenarios:

- In 2013 the archbishop of Canterbury, the senior bishop of the Church of England, rolled out an ambitious plan to put predatory payday lenders in the United Kingdom out of business. One of the worst offenders, Wonga, charged customers seeking short-term payday loans interest rates as high as 5,853 percent APR (annual percentage rate). (That comma is not a typo; Wonga was charging an interest rate of almost 6,000 percent.) Deeming this practice unethical, the church sought to support community financial institutions in order to encourage alternative lenders and with the goal of eventually putting Wonga out of business. But this worthy effort was undermined when it was revealed that the Church of England had invested some endowment funds in Wonga. So the church was making money off of the very same exploitative business it was trying to eradicate. Money the church was using for its mission downstream was polluted by the source upstream.

- A well-established nonprofit has been doing an annual fundraising gala for the past decade. It has become a staple activity in the calendar for the year. And it appears to be successful as it raises six figures of donated income. But as they come up on the 10th anniversary of the event the event planning team decide to take a closer look at the cost and benefit of the gala. When all the accounting is done it becomes clear that the full cost of putting on the event, including staff time and volunteer energy, is larger than first thought and the gala is only generating a small amount of net income after expenses are deducted. Furthermore it is clear that the amount of time spent planning for and holding the gala could be better spent delivering the program services the organizations exists to provide in the community.

- A church located in a prime location rents out space to five community organizations during the week including three Sunday school classrooms and two lounges. The church leadership is really pleased to be making use of space that would otherwise be empty throughout the week. And by renting out space the church brings in some revenue. But after a few years of doing this the church leadership undertakes a mini “audit” of their rental program and they find two problems. First, only one of the five rental agreements brings in enough money to more than cover the full cost of hosting the groups in the church space. After accounting for utilities, cleaning costs, staffing, and other administrative overhead of running the rental program, the church discovers that even though groups are paying some rent, the church is actually losing money on four of the five leases. Even more problematic, the church discovers that two of the five organizations renting space are not aligned with the churches’ mission. So the church is losing money by hosting organizations that are not furthering the mission objectives that the church has.

All three of these examples get to the heart of the importance of aligning money and mission for social impact organizations like churches and nonprofit organizations. In each of these examples the net financial impact, the mission impact, or both is negative and brings in question some of the core activities the organization is engaging in. Money and mission are not well aligned.

Mission

Social enterprises, nonprofits, church, B-corps, and other social impact organizations exist to fulfill their core mission whether that be serving people in their neighborhood, addressing a core systemic inequality, supporting spiritual growth, caring for the environment, inspiring people through the arts, or any number of other important causes.

Money

Mission is primary. Always start and design activities with mission in mind. But almost all social impact organizations need money to accomplish their mission. Money pays for programs, staff, and direct constituent support. Money helps organizations tell their stories, and generate new funding. Without attending to the business of an organization there will be no money for the mission. Attending to both money and mission is essential for successful social impact to happen.

Mission & Money Aligned

And the two are intimately and deeply tied to each other. The way an organization generates money can positively or negatively impact its core mission purpose. And the mission activities an organization pursues can generate or cost money. This is especially important as many nonprofit and social impact organizations are increasingly looking to generate earned income and not just fund their mission through donations. Social enterprise, as this is often called, has tremendous promise, but also involves some risk if money and mission are not well aligned.

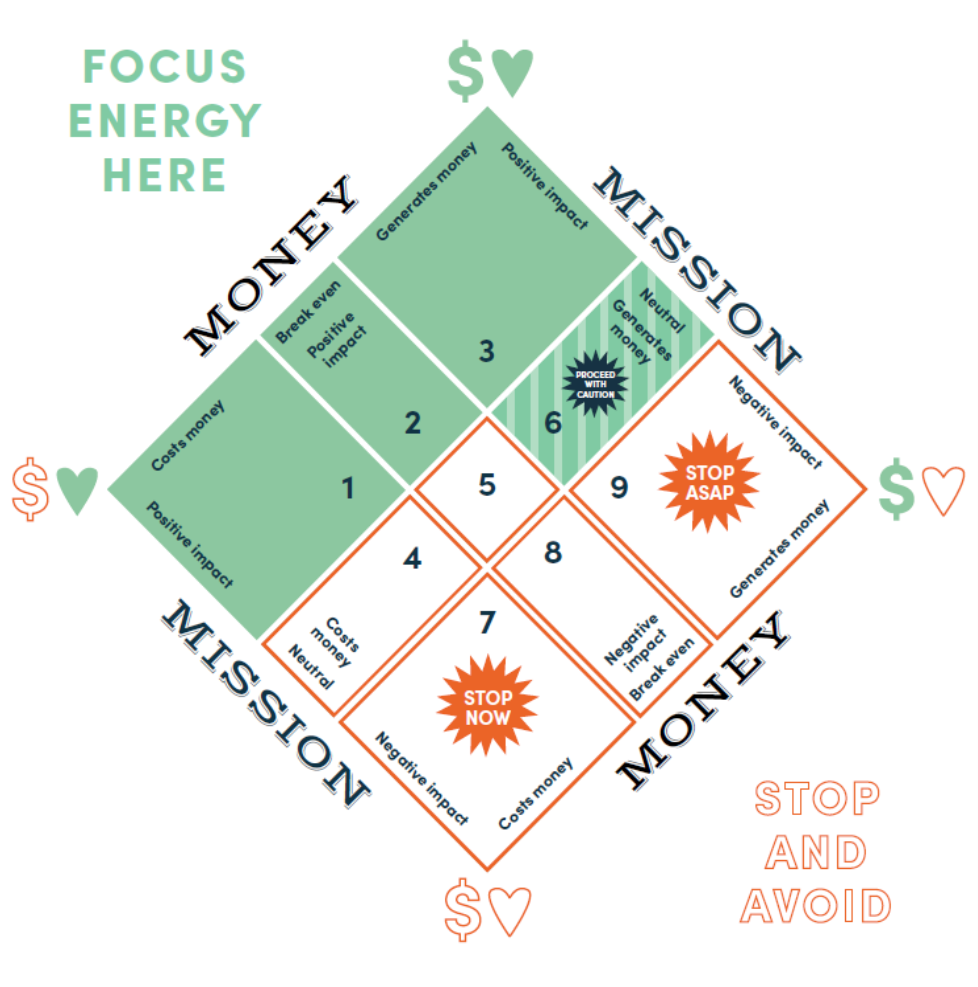

Evaluate your money and mission alignment

RootedGood has built a heuristic map and planning tool that can help social impact organizations, including churches, evaluate your alignment of money and mission in order to do both, better. The map is divided into 9 boxes. Activities that fall in along the upper left on this diamond (the green boxes – 1,2,3) have a positive mission impact. Those in the middle are

neutral (4,5,6)—they neither contribute to nor detract from your mission impact. Those in the bottom third (7,8,9) have a negative mission impact—they are harmful to the mission of the organization or to what you want to see happen in the world.

In a similar way you can map the financial impact as you move along on the map. Activities and programs that fall along the upper right side (3,4,9) generate money. They have a net positive financial impact on the organization. Those in the middle third basically break even (2,5,8). And those in the lower left have a net negative financial impact (1,6,7). They cost more money than they bring in. By mapping what you do into one of these nine boxes you can evaluate the overall impact of your activity on the mission and financial resiliency of your organization. You can see

where money and mission align and where they do not.

The payday lending example above would fall into box 9 – money is being made from an investment in a business that is antithetical to the mission of the organization. The fundraising gala example could fall into boxes 1, 2, 5, or 6 depending on how valuable the gala is to the overall mission of the organization and how positive, negative, or neutral the financial impact really is. The church rental example likely falls into boxes 6 and 7 where there is no positive financial impact and the mission impact is neutral or perhaps even detracts from other aspects of the church’s mission.

If you would like to give this tool a try for yourself it is available within my book, “We Aren’t Broke: Uncovering Hidden Resources for Mission and Ministry,” coming out on June 1st. You can also get access to RootedGood’s Money and Mission Alignment tool that walks you through the process of mapping your activities and provides questions for reflection to help you apply it in your context. This tool is available for purchase or for free (along with many other tools) as part of a Mycelium Network membership. You can access the tool via downloadable PDF and get started aligning your money and mission right away!

One more example

The social business Guayakí started in 1996 with a goal of protecting 200,000 acres of South American rainforest while also creating over one thousand living wage jobs. Guayakí achieves this goal through the sale of yerba mate beverages that are distributed widely throughout the United States. They work with indigenous cooperatives that supply them with yerba mate. The farmers have an incentive to preserve, and even restore, the rainforest, for yerba mate naturally grows under tree cover in Brazil, Argentina, and Paraguay. Ultimately, the more drinks Guayakí sells at 7-Eleven convenience stores, Safeway, and other outlets, the more acreage of the rainforest is protected. The more successful they are with production and sales, the more money they make and the more impact they generate. Guayaki has found money and mission alignment in their business model. This is an inspiration to all of us as we seek to have the most impact we can while generating sustainable revenue.

Get inspired with Givelify, the highest-rated, most reviewed, and most downloaded mobile giving app

About the author: Mark Elsdon lives and works at the intersection of money and meaning as an entrepreneur, pastor, speaker, and author. Mark’s new book, “We Aren’t Broke: Uncovering Hidden Resources for Mission and Ministry,” explores how faith-based organizations can use investment assets and property for mission impact and financial resiliency. Mark is co-founder of RootedGood, which seeks to create more good in the world through social innovation; executive director at Pres House on the University of Wisconsin’s Madison campus; and owner of Elsdon Strategic Consulting. He holds degrees from the University of California, Berkeley, Princeton Seminary, and the University of Wisconsin School of Business. Mark is an ordained minister in the Presbyterian Church, USA, and lives in Madison, Wisconsin. He is an avid cyclist and considers it a good year when he rides more miles on his bike than he drives in his car.