Keep Your Data Safe With PCI Compliance Best Practices

At Givelify, the safety and security of sensitive information is our top priority. Each year, we undergo an extensive compliance review with an external auditor to ensure we adhere to Payment Card Industry (PCI) rules and guidelines and provide the best security for all transactions.

What is PCI compliance?

PCI compliance refers to security standards and practices designed to protect sensitive payment card information from theft or misuse.

Compliance with PCI standards helps ensure the secure handling of payment data and reduces the risk of data breaches.

What does PCI compliance mean for your organization?

PCI compliance isn’t just important for Givelify. It’s important for your organization, too.

The PCI standards community outlines simple steps that everyone can take to lessen the risks associated with handling and storing credit card information.

To better understand the concept of “PCI compliance,” let’s consider a scenario where a family discovers a potential threat to their home after returning from vacation.

We’ll cover each PCI security standard and best practices you and your organization can take to enhance online security and protect personal information.

Intrusion Detection

As the family pulls into their driveway, they hear their alarm system going off.

In PCI compliance, intrusion detection involves monitoring network and system activities to identify and respond to unauthorized or suspicious behavior.

The purpose of intrusion detection is to quickly identify potential security threats and take appropriate action to safeguard payment card data.

Just as alarm systems detect unauthorized entry into a home, intrusion detection systems monitor unauthorized access to payment card information.

Best practices for your organization:

- When browsing online, always ensure that the website uses HTTPS connections, especially when making online payments. The “s” in HTTPS indicates that the website is secure.

- Routinely check your credit card statements for any unusual activity that may indicate fraud or identity theft.

Incident Response Plan

The family immediately calls 911 and waits outside their home until the police arrive.

In PCI, it’s imperative to develop and regularly test an incident response plan. This plan outlines the steps to minimize damage in case of a security incident.

When the alarm went off, the family called the police and activated their emergency response plan. Similarly, organizations must have an incident response plan for PCI compliance to handle security breaches and data incidents.

Best practices for your organization:

- Be proactive about online security. Use unique, complex passwords, enable two-factor authentication, and keep your software up-to-date.

- Know what counts as a security incident, like unauthorized account access, identity theft, or suspicious device activity.

- Identify key contacts that can assist you in the event of a security incident, such as your bank, accountant, or the authorities.

Regular Audits and Assessments

When the police arrive, they walk around the home to look for any signs of forced entry.

Regular audits and assessments help ensure ongoing compliance with PCI standards.

Similar to how the police checked for signs of forced entry, a business must also undergo regular audits to ensure they meet PCI compliance standards.

Best practices for your organization:

- Keep your online accounts secure by updating your security settings regularly, using strong and unique passwords, and enabling two-factor authentication.

- Regularly review all devices connected to your home or business network to ensure they are up-to-date and secure.

Firewall Protection

As the police walked around the home, they checked to ensure all the doors and windows had been locked.

In PCI, implementing firewalls helps control and monitor incoming and outgoing network traffic, safeguarding against unauthorized access.

Just like homes have secure doors and windows to prevent unauthorized access, PCI compliance requires firewalls to protect cardholder data entry points from external threats.

Best practices for your organization:

- Use a router with a built-in firewall to help protect your devices from external threats.

- Keep your system up-to-date with the latest software updates to ensure protection against potential vulnerabilities.

Community Collaboration

Seeing the police car outside, the family’s neighbor walks across the street and mentions that he saw a car leave their home earlier that day.

Collaboration among organizations in the payment card industry enhances security and compliance efforts by sharing information, experiences, and best practices related to PCI.

Just like neighbors form a neighborhood watch to enhance the security of their area, businesses in the payment card industry share threat intelligence to strengthen security.

Your organization can improve its cybersecurity and benefit the broader community by adopting similar principles.

Best practices for your organization:

- Stay informed about online security and help others do the same by guiding them on creating strong passwords, adjusting privacy settings, and identifying and responding to phishing attacks.

- Be vigilant and report suspicious online activities and scams to help protect others.

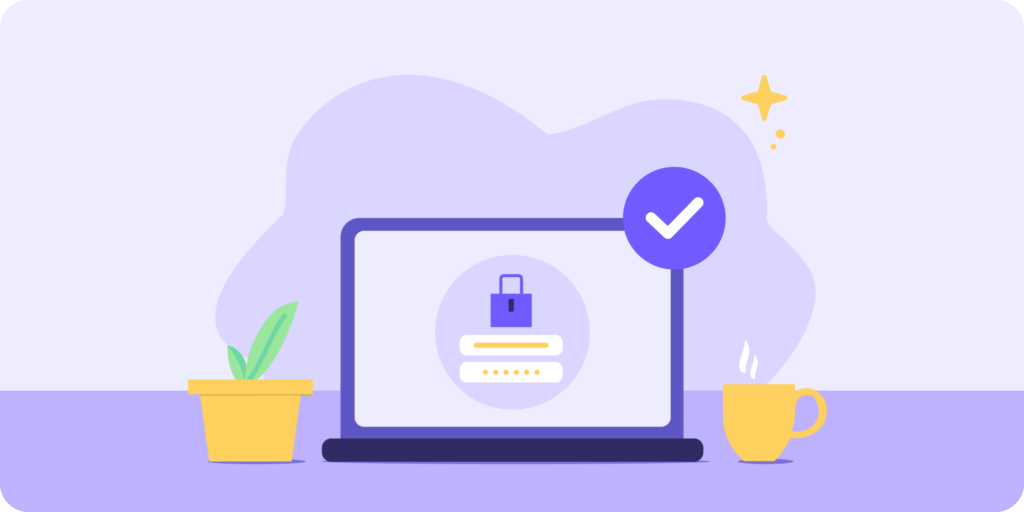

Access Control

The family walks up to the front porch and notices that the green flowerpot, where they usually hide the spare key, has moved.

Access control in the context of PCI refers to a set of measures that include user authentication, implementation of strong password policies, and role-based restrictions to ensure the security of sensitive information.

Locks and keys control access to a home. Similarly, PCI compliance restricts access to payment card data to only authorized individuals or systems.

Best practices for your organization:

- Create strong passwords by using a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like birthdays or names.

- Limit the sharing of personal information. Be cautious when granting access to apps or websites that request more information than necessary.

- Protect yourself from phishing attempts that try to trick you into revealing sensitive information. Avoid suspicious links in messages and verify requests for personal information.

Regular Software Updates and Patch Management

The family admits the battery of the front doorbell camera wasn’t charged, so there’s no video recording available for the police.

With PCI, it’s essential to regularly update all systems and software with security patches and updates to prevent the exploitation of known vulnerabilities

Similar to how a home requires regular maintenance for locks, alarms, and home security cameras, regular security patching is necessary to keep systems and software secure.

Best practices for your organization:

- Enable automatic updates for your system and software to quickly get the latest security patches.

- Back up important data before significant updates, especially those involving your operating system.

Logging and Monitoring

The neighbor mentions that their home security camera might have captured something.

In PCI, logging and monitoring solutions enable organizations to quickly detect and respond to suspicious activities or security breaches.

Security cameras monitor and record activity, providing evidence if needed. Similarly, PCI compliance requires monitoring and analyzing all payment card data activities to detect and respond to security incidents.

Best practices for your organization:

- Regularly check your credit report for inaccuracies, suspicious activities, and unauthorized accounts. Consider using credit monitoring services for real-time alerts.

- Install reliable security software with logging features and review the logs regularly to identify any threats or unusual patterns.

Data Encryption

The family enters their house to check for missing items, including the safe in their home office. Fortunately, everything seems to be in its place.

In the world of PCI, it is crucial to encrypt payment card data both during transmission and storage. This ensures that if the data is intercepted, it cannot be read without the proper encryption keys.

Encryption of payment card data makes it unreadable during a security breach, similar to how a safe protects valuables.

Best practices for your organization:

- For enhanced security, enable WPA3 encryption on your Wi-Fi network to protect transmitted data and prevent unauthorized access.

- Make sure the websites you visit have HTTPS. Look for a padlock icon in the address bar, indicating a secure connection.

Vendor Compliance

The family finds a note from the pet sitter on the back of the front door, explaining that they used the spare key under the flowerpot to enter the house.

If your organization works with third-party vendors who process payment card data on your behalf, it’s crucial to ensure that they also comply with PCI standards. This may require contractual agreements and assessments.

Just as you’d assess a pet sitter before inviting them into your home, businesses must assess the security practices of third-party vendors. This ensures that vendors who handle payment card data do not pose a security risk.

Best practices for your organization:

- When choosing online services, applications, or platforms, opt for those from credible and established vendors. Take into account reviews, ratings, and the vendor’s security reputation.

- Check the vendor’s security practices, including data handling, encryption measures, and privacy policies. Ensure the vendor is transparent about how they handle your data.

Let’s recap: How PCI compliance can help keep your data safe

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that businesses handling credit card transactions maintain a secure environment.

By adopting these standards, your organization can help to ensure the safety of both your and your donors’ data.

You can do this by taking the simple actions we’ve outlined in this blog, including:

- Using secure websites when browsing online

- Creating complex passwords

- Routinely monitoring bank accounts

- Keeping computer software up-to-date

- Staying vigilant against phishing attempts and scams

By following these steps, you can safeguard both your and your donors’ sensitive information while reducing the risk of security incidents.