How Economic Trends Will Shape Faith and Church Giving in 2025

Economic trends don’t just affect financial markets — they shape our daily lives — including those in your congregation. And, in turn, these trends influence the giving habits that sustain your place of worship.

As we reflect on 2024, a year marked by economic recovery and resilience, several trends played a role in faith giving. Understanding these trends is crucial for planning and maintaining generosity in the year ahead.

So, what’s in store for 2025?

In this blog, we’ll explore the economic outlook for the new year and how it may impact faith giving in your community.

Reflecting on 2024: A year of recovery and resilience

Looking back, 2024 marked a year of steady economic recovery, providing much-needed relief after months of rapid price increases. However, even as inflation eased, many families continued to feel the lingering effects of high prices.

Despite these challenges, improving economic conditions influenced giving patterns across faith communities, helping pave the way for a generous year.

Here’s a snapshot of the key economic trends we observed in 2024 and how they impacted the faith and church giving landscape:

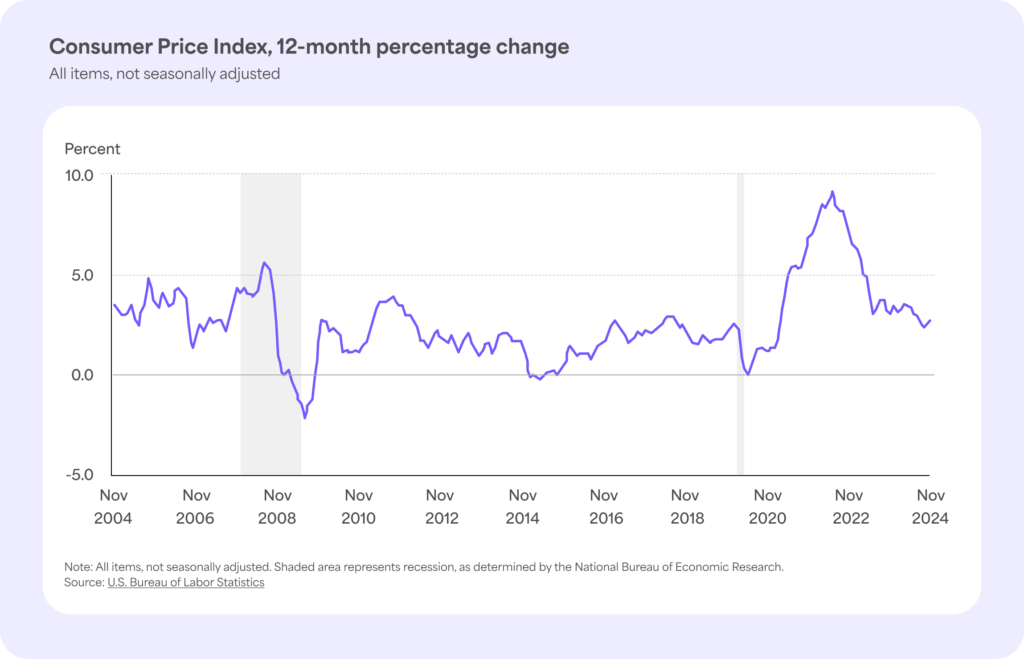

- Decreasing inflation: After peaking at 9.1% in 2022, inflation continued to ease in 2024, down to 2.7% as of November 2024 and nearing the Federal Reserve’s target inflation rate of 2%. This decrease brought some relief from the unpredictable price hikes of the past couple of years. Still, the cost of goods remained elevated despite lower inflation.

Why is inflation important, and how does it impact giving?

Inflation plays a significant role in shaping how people spend their money. When inflation is high, the cost of everyday essentials such as groceries, gas, and housing increases. As a result, households have less disposable income — the money remaining after essential expenses — which limits spending on non-essential items like dining out, traveling, or charitable giving.

For example, if groceries that once cost $100 now cost $120, that extra $20 has to come from somewhere — often by dipping into one’s savings or cutting back on non-essential expenses.

However, when inflation eases and prices stabilize, or stop rising as quickly, disposable income increases. This sense of stability helps people feel more confident about spending on non-essentials, including donations to organizations they care about.

“Internal studies using Givelify data show that disposable income is correlated with giving. When people have to spend more on essentials, few people give and many who give, give less.”

– Abiodun Mafolasire, Head of Data Science at Givelify

Thus, when inflation is low, charitable organizations often benefit from an increase in giving.

- Low unemployment: In 2024, the U.S. job market demonstrated resilience, maintaining low unemployment rates that supported economic stability. As of November 2024, the unemployment rate stood at 4.2%, according to the U.S. Bureau of Labor Statistics. Low unemployment increases income and financial stability for households, giving people more confidence and resources to spend on goods, services, and charitable giving.

- Interest rate cuts: The Federal Reserve reduced interest rates by one percentage point, lowering the federal funds rate to 4.25-4.5%. This rate affects how much it costs banks to borrow money. When those costs decrease, banks often pass these savings on to consumers. As a result, borrowing costs for items like cars and credit cards typically become more affordable, providing households with more disposable income. However, it can take time for these savings to reach borrowers, as lenders gradually adjust their rates. This delay may explain why some households still feel financial strain despite recent interest rate cuts.

- A stabilizing economy: While concerns about a potential recession loomed early in the year, these fears never materialized. Instead, the economy achieved a “soft landing” — a situation where inflation is brought under control without triggering an economic downturn or a significant rise in unemployment.

Overall, the economy outperformed expectations, fostering increased consumer confidence and greater financial stability through a combination of easing inflation, steady job growth, and favorable monetary policies.

How these trends affected faith and church giving in 2024

Just as the U.S. economy did, faith giving showed resilience in 2024.

In fact, 95% of faith-based givers expressed a desire to maintain or increase their contributions in 2024, according to the 2024 Giving in Faith report. And, it appears this sentiment held true.

As inflationary pressures eased, faith givers maintained their commitments to their places of worship and giving remained steady.

Toward the end of the year, as economic confidence grew, we also saw more people participating in giving. This led to a slight increase in year-end donations.

Election years and their impact on giving

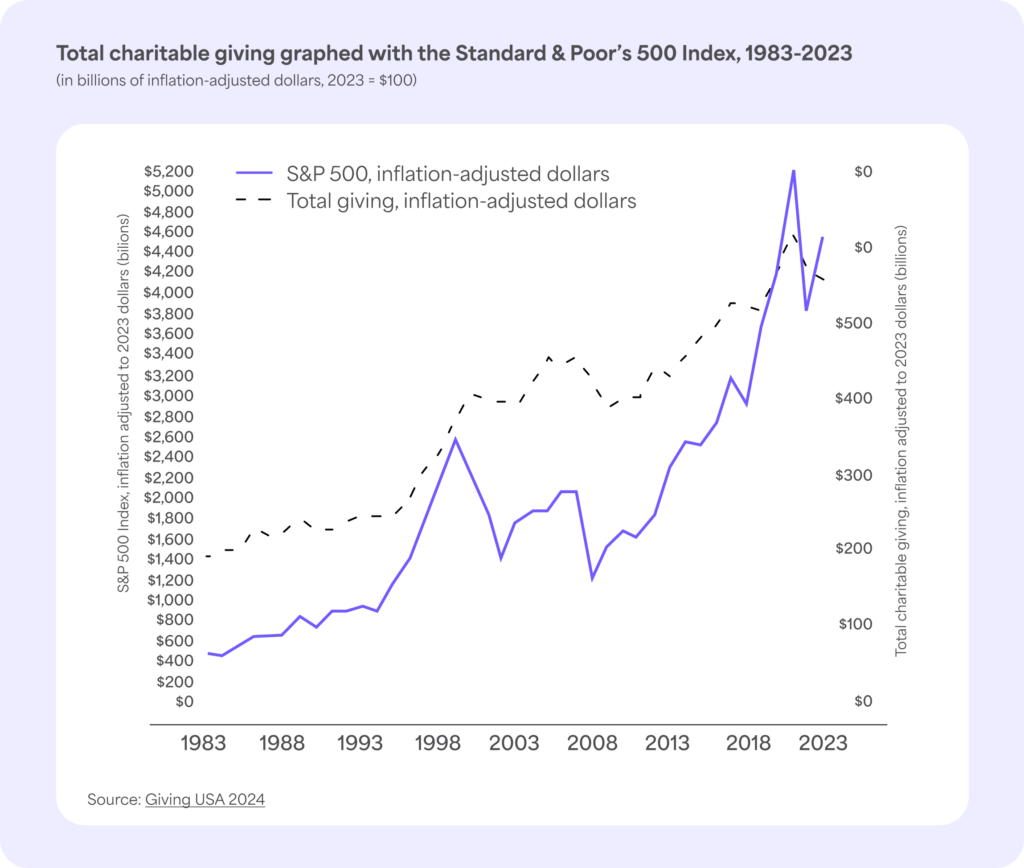

Election results often have a positive ripple effect on financial markets. Following the 2020 U.S. presidential election, the stock market experienced significant gains that extended into 2021. Similarly, the 2024 election results sparked another market upswing.

Increases in charitable giving closely follow stock market performance. According to the Giving USA 2024 report, there is a strong correlation between changes in total giving and the S&P 500’s year-end performance. When the stock market rises, households tend to feel more financially secure, making them more inclined to give.

Givelify data also reflects this trend, with average gift sizes increasing after the November 2024 election. This boost in end-of-year giving closely followed the market’s post-election gains.

If these historical patterns hold, the positive momentum from 2024 could signal a promising outlook for generosity in 2025.

These trends highlight how economic stability can influence generosity, and why understanding these factors is vital as you plan for the year ahead.

Looking ahead: Economic predictions for 2025 and the impact on faith giving

As we move into 2025, although uncertainty remains, the economic outlook remains optimistic. Here’s what you can expect and how these trends may influence faith and church giving in the year ahead:

Economic predictions for 2025

- Stable inflation: Inflation is expected to continue stabilizing, providing additional relief from the rapid price hikes of recent years. While goods like groceries remain almost 28% more expensive than they were five years ago, according to the U.S. Bureau of Labor Statistics, prices will no longer rise as rapidly. This stability will help ease financial pressure on households, allowing for increased spending on non-essential items.

- Reduced interest rates: The Federal Reserve is projected to make modest interest rate cuts in 2025, likely totaling around half a percentage point. These reductions, though gradual, will help to further lower borrowing costs and free up disposable income for many families. At this time, experts do not expect rate hikes this year.

Overall, despite some uncertainty, the economy is expected to hold steady in the coming year, with no signs of a recession on the horizon. As economic conditions continue to stabilize, households are likely to experience more predictable budgets and enjoy greater flexibility in their spending.

The impact on 2025 faith and church giving

Given these predicted economic conditions, faith giving in 2025 is poised to remain strong. Here’s what you can look forward to:

- Continued stability: We anticipate faith and church giving to match or slightly exceed 2024 levels, with a potential increase of 2–3%.

- Increased capacity to give: As households experience steady or slightly improved disposable income, their ability to contribute to places of worship is likely to grow.

- Predictable costs: With prices stabilizing, households will face fewer financial surprises, allowing them to sustain or expand their giving commitments.

Pastors and faith leaders can take these predictions as an encouraging sign as they start planning for opportunities to inspire generosity in 2025.

Building on resilience in 2025

Pastors and faith leaders have a unique opportunity to build on the resilience and generosity demonstrated by their communities in 2024. By understanding the economic trends shaping the year ahead, you can adapt your giving strategies to meet the needs of your congregation and maximize your place of worship’s giving potential.

Faith giving has proven strong, even amidst economic shifts, and this strength is expected to continue into the new year. With thoughtful planning, purposeful stewardship, and a focus on accessibility, you can inspire your congregation to embrace generosity to continue making a meaningful impact in 2025 and beyond.